Sold Call Options on crypto Ethereum - potential income of 1.85% in 7 days

On March 10, 2023, I sold 1 call option on Ethereum cryptocurrency with an expiry set, on March 17 22, 2023. For this trade, I got a premium of 0.0185 ETH / $25.97

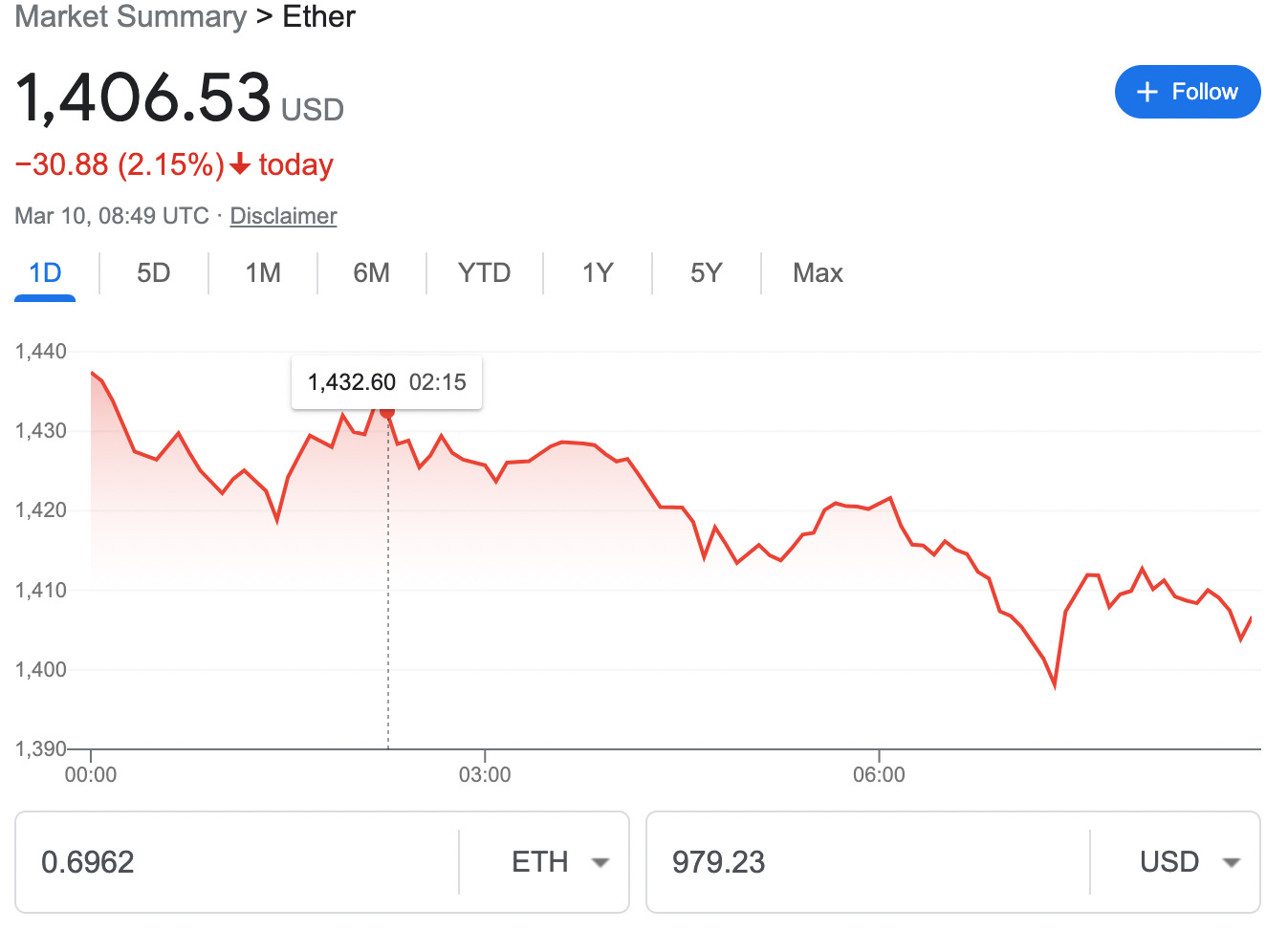

I actually don't have 1 ETH, just 0.6962 ETH, which equals $973.92 at the time of writing.

Selling crypto options is pretty much the same as selling stock options, except they are settled in crypto, require less capital, are settled European style (cannot be assigned before the expiry), and can go totally wrong.

Ethereum is a decentralized, open-source blockchain with smart contract functionality. Ether is the native cryptocurrency of the platform. Among cryptocurrencies, ether is second only to bitcoin in market capitalization.

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset

Here is the trade setup:

ETH-17MAR23-1450-C trade open sell 1 0.0185

For this trade, I got a premium of 0.0185 ETH (after commissions) or about 1.85% potential income return in 7 days, if options expire worthlessly.

What happens next?

On the expiry date, March 17, 2023, ETH is trading under $1,450 per coin - the call option expires worthlessly and I keep the premium and start over - if ETH trades above $1,450 on the expiry date, I pay the difference in crypto.

Say ETH trades $1,520 on expiry, I need to pay the difference between the spot price and strike price, which is $70, or converted it back to ETH which would equal 0.0482ETH.

I would be left with 0.69+0.0185-0.0482= 0.6603 ETH

Converted back to USD = $1,003

Despite would loss on crypto itself I would gain in dollar terms.

Nevertheless, I will try to roll up and away for credit if challenged.

My plan is to grow this Ethereum portfolio to at least 1 ETH or $2,000 in a foreseeable future (May / June 2023) and I'm seriously considering getting there with the help of writing call options + depositing some small bits into the crypto.

Interested to learn more about trading crypto options? I'm putting together an online course Crypto Options Trading Strategies, feel free to pre-enroll!