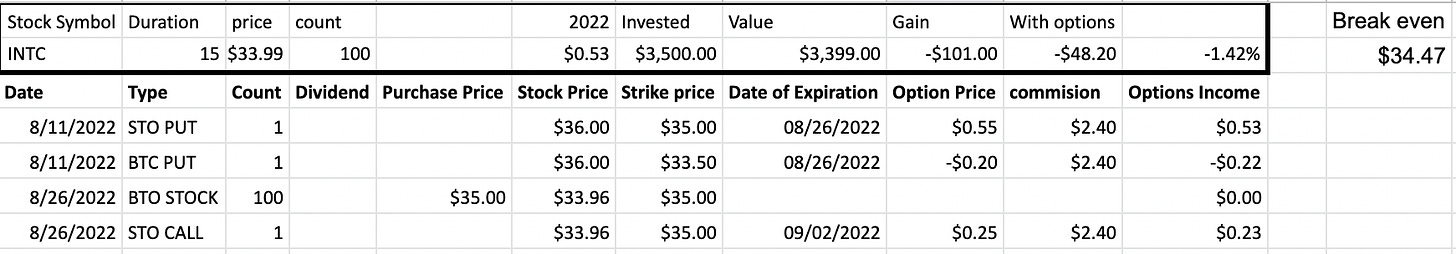

On August 26, 2022, I got assigned 100 shares with INTC stock at the price of $35 per share. I originally opened this trade on August 11, 2022 as a Credit spread (35/33.5).

As the stock market headed into a losing week, so did INTC stock fall under my strike price and I was left either to roll out or take the assignment. I decided on the second.

Intel Corporation, commonly known as Intel, is an American multinational corporation and technology company headquartered in Santa Clara, California.

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

With INTC trading below today’s expiry strike price of $35, I decided to take this assignment and buy 100 shares at 35 and sell a covered call with next Friday’s expiry

here is the trade setup:

SLD 1 INTC Sep02'22 35 CALL 0.25 USD

For this trade, I got $25 (before commissions)

What happens next?

On the expiry date, September 02, 2022, INTC is trading at under $35 per share - options expire worthlessly and I keep premium and start over - if INTC trades above $35 on the expiry date, my 100 shares will get called away and I will realize a profit of $53 ($0 value gain and +$53 options premium) or potential income of +1.51% in 22 days

Break-even price: $35-$0.53= $34.73

Running Total 4 Trades since August 11, 2022

Options income: $53

Value gain: $0

Hey: Enjoy reading what other premium sellers are doing. Curious why you started out with a spread then turning it into a cc. Why not buy an otm put when you got assigned or you got more bullish on the stock?