Covered Calls with Crypto Options at Deribit (Example with ETH)

I’ve been trading crypto options for a few years with the Deribit platform, most of the time I’ve made a nice income, but a few times I have lost a lot. And then I finally stopped trading at Deribit at all.

The saying it picks up like sparrow but sh*ts like an elephant indeed applies to trading options with Crypto.

I've made several articles about my journey with crypto options, one such as Selling Covered Calls on Crypto (Ethereum / Bitcoin) with Deribit? has gained some popularity and generates a few comments from interested parties.

As I have stopped trading crypto options with Deribit and instead focus on dollar-cost averaging while waiting for a real Bitcoin ETF listed on the US exchanges, I still decided to take a fresh look. And gosh, good I did, as indeed I started thinking maybe I’m not getting something (read till the end to get what I’m talking about)

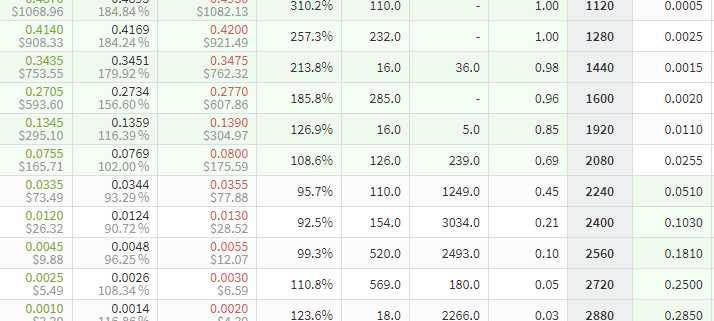

Quick research, with ETH trading at $2,200 on June 20, 2021

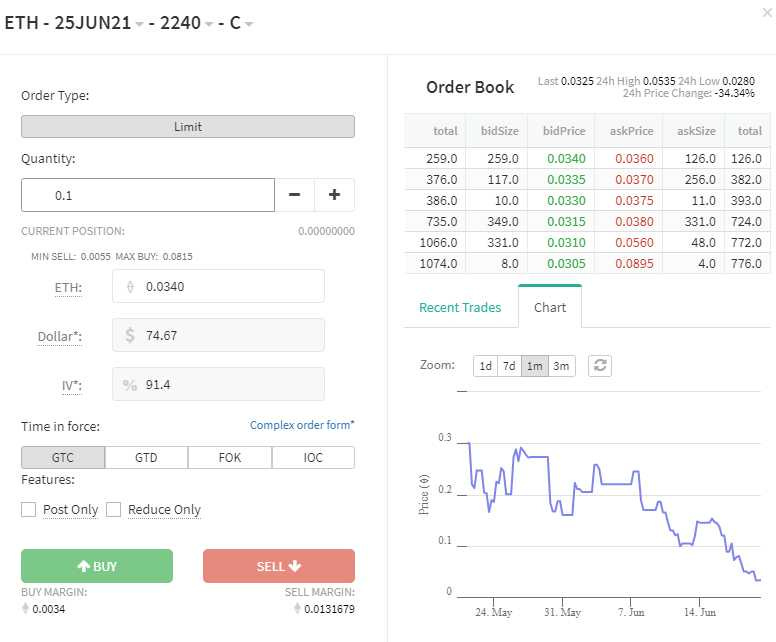

We could sell June 25, 2021 expiry call option with a strike price at $2,240 and get 0.0335 ETH or a strike price of $2,400 and get 0.0120 ETH

For the simplicity of this article, I will stick with the more aggressive strike price of $2,240

I tried to make some calculations with Position Builder from Deribit but got no luck, so will try to do my calculation myself.

To sell one call options with ETH on Derbit platform we are obligated to provide a margin of more than 0.1 ETH.

The minimum we are required to trade this option is 0.131 ETH

Say we buy 0.131 ETH at $2,200 and sell a call option with a strike price of $2,240. Our total investment - $288.2

what happens next?

If on the expiry date (June 25, 2021) ETH trades under $2,240 - very well we keep the premium and start over. This is our ideal scenario.

But now let us look at what happens if ETH reaches and breaks our strike price, say ETH trades at $2,300, we are obligated to pay the difference in crypto, I know this sounds a bit complicated, and trust me, it is…

Anyhow, with $2,300 it means we need to deliver the difference, which is $2,300-$2,240, and convert it to crypto…

60/2300= 0.026 ETH, we are obligated to pay 0.026 ETH

OK, but as the price rise, our original investment of $288.2 has a worth of $301.3 we gain back something on the price difference, the final math should look like this

0.131 + 0.0365-0.026 = 0.1415 ETH

If we convert it back to the USD value = $322.45, we have made about $34.25

Let’s look at what happens if ETH trades at $3,000

As we are trading just 5 DTE options, a scenario that ETH will rise about 40% in just 5 days is highly unlikely, but hey I have seen it happen a few times, so nothing is unlikely.

We need to deliver the difference, which is $3,000-2,240, and convert it to crypto… 760/3000= 0.2533 ETH, we are obligated to pay back 0.2533 ETH…

OK, but as the price rise, our original investment of $288.2 has a worth of $393, we gain back something on the price difference, the final math should look like this

0.131 + 0.0365-0.2533 = -0.0858 ETH

If we convert it back to the USD value = -$257.4, wow, we just lost -257.4USD by selling call options with ETH.

This is something that would never happen in the stock market and I would stay away from trading options with crypto settled in crypto itself.

Are there some alternatives? Personally, while there is no crypto ETF listed on US exchanges I would prefer just dollar-cost averaging once a week or once a month, and to earn something from crypto I might consider lending my coins, I even would consider Algo trading, but hell not selling options which are crypto cash-settled.