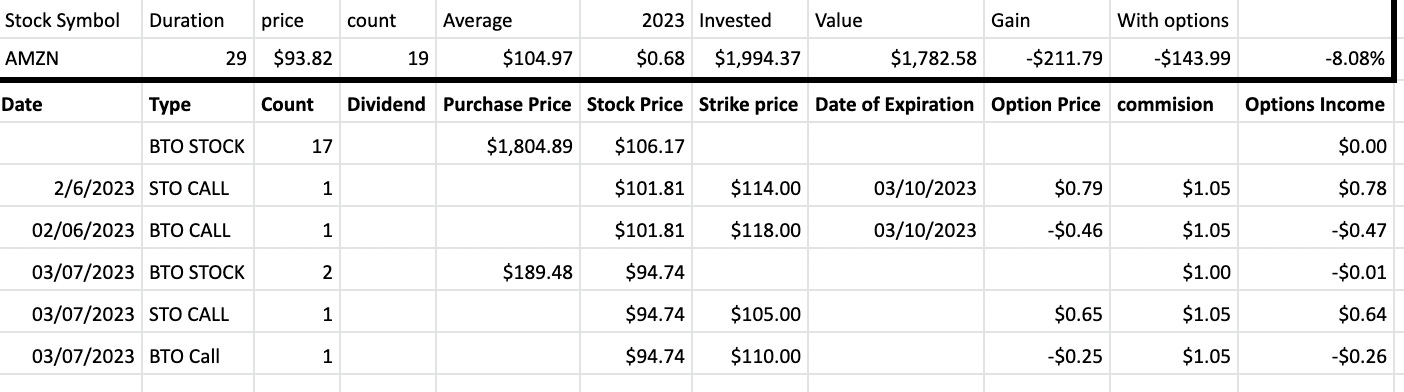

Call Bear Spread on Amazon stock – risking $500 to make $35

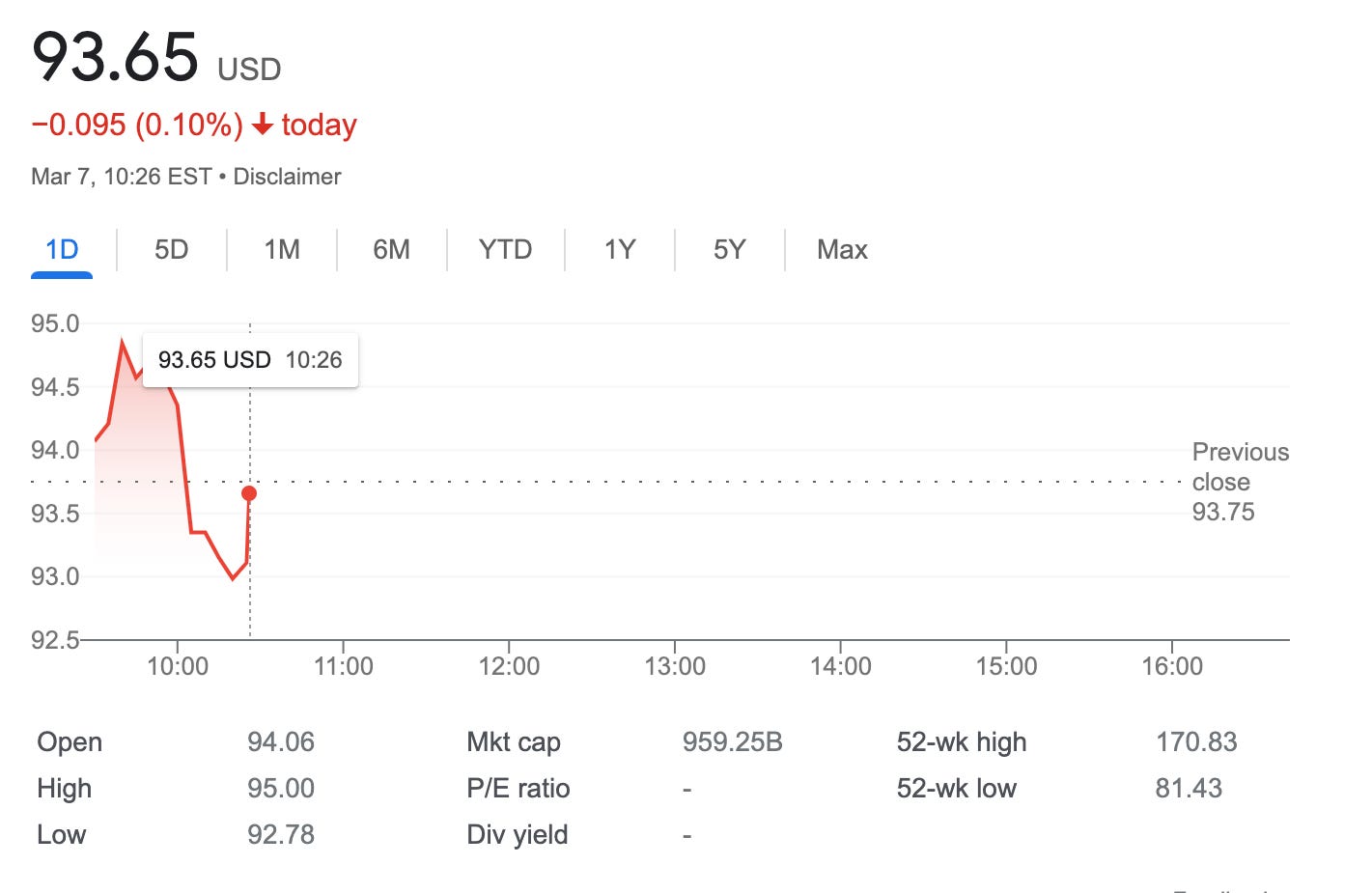

On March 7th, 2023, I sold 1 bear call spread on Amazon stock with strike prices at $105 and $110 with expiry on March 31, 2023). For this trade setup, I was rewarded with $34.90 (after commissions).

When setting up this trade I was looking for a high probability winning trade and chose my strike prices with Delta less than 0.2.

A call bear spread is an options trading strategy that involves selling a call option with a lower strike price and simultaneously buying a call option with a higher strike price on the same underlying asset. In this case, I sold a call option with a strike price of $105 and bought a call option with a strike price of $110.

I decided to go for a call bear spread as I don't have actually 100 shares to deliver if challenged. I have only 19.

In case the price of Amazon stock rises and my short call option is exercised, I only have 19 shares, which may result in an assignment, meaning I would have to buy the additional shares at the market price to deliver the shares to the option buyer.

In case of danger, I will try to roll up and forward the short call option.

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

here is the trade setup:

SLD 1 AMZN MAR 31 '23 105 Call Option 0.62 USD

BOT 1 AMZN MAR 31 '23 110 Call Option 0.24 USD

What happens next?

On the expiry date, March 31, 2023, AMZN is trading under $105 per share - options expire worthlessly and I keep premium - if AMZN trades above $105 I'm troubled as I need to deliver shares I don’t actually have, to avoid such scenario I will try to roll up the strike price.

In case AMZN would rise to $105 or above at the expiry, I would risk my shares being called away, but as I have only 19 AMZN shares I would have to buy missing shares paying the market price.

Using dollar-cost averaging my average cost per AMZN share at the moment is $105.02

For example with AMZN expiring at $110 (my max loss) I would be left with:

100*105-19*105.02-81*110=-405.38

My max risk is $405.38 to earn 35$. I assume this is a risk worth taking, as in the case of a sudden stock price rally close to $105, I would try to roll up and forward this position trying to avoid an assignment.

Max loss: $-405.38

Break-even price: $105+$0.35= $105.35

In total: 6 trades since February 6, 2023

Options premium: $68